Latest Local News

Bridge painting on Farmingdale Road over Interstate 72 near Springfield set to begin Monday, May 19Carr & Dymova: Lawmakers seek to reverse Illinois law penalizing companies that boycott IsraelAP: Biden has been diagnosed with aggressive prostate cancerMan found dead in wooded area east of Pawnee on Friday afternoonSpringfield PrideFest, Old Capitol Art Fair attract thousands to downtownTo counter food deserts, Pritzker awards $10 million in new grants for local grocery stores in IllinoisTo counter invasive carp, Illinoisan Copi to be featured at National Restaurant Association ShowHancock: After 150 years, Mary Lincoln's 'madness' still haunts American psycheCWLP announces crews out across Springfield dealing with power outages after storm front struck city late Friday afternoonNational Weather Service advises caution with thunderstorms in Central Illinois including large hail and wind gustsBill requiring stricter law enforcement hiring practices on its way to Governor JB Pritzker's deskVeterans Assistance Commission of Sangamon County set to relocate its offices later this MaySpringfield man arrested early Tuesday in connection with damaged ATMFourteen new firefighters sworn in at Springfield Firefighters' Lake Club ceremony on ThursdayAubrey: Plan to limit scope of 'crime-free housing' ordinances clears Illinois Senate committeeSpringfield resident found dead in Southwind Park on Thursday afternoonArmed bank robbery suspect in custody in Springfield after several stick-ups in less than a weekSzalinski: Speaker removes Democratic Rep. Fred Crespo from committee chairmanship for 'not communicating'CWLP announces 90th birthday party, photography challenge for Lake Springfield slated for start of JuneSzalinski: Governor's office cuts revenue projection by $500M in latest downward estimate

Bridge painting on Farmingdale Road over Interstate 72 near Springfield set to begin Monday, May 19

Fox: Native ancestors' return to rest: A paperwork-laden process underway in Illinois

AP: Biden has been diagnosed with aggressive prostate cancer

Springfield PrideFest, Old Capitol Art Fair attract thousands to downtown

Carr & Dymova: Lawmakers seek to reverse Illinois law penalizing companies that boycott Israel

Man found dead in wooded area east of Pawnee on Friday afternoon

Bill requiring stricter law enforcement hiring practices on its way to Governor JB Pritzker's desk

Szalinski: Governor's office cuts revenue projection by $500M in latest downward estimate

AP: Great Lakes' $7 billion fishing industry may get a reprieve from the great carp invasion after all

CWLP announces 90th birthday party, photography challenge for Lake Springfield slated for start of June

CWLP updates lead service line replacement work across Springfield

North Grand Ave in Springfield between 7th and 9th streets set to be closed across next five weeks for Springfield Rail Improvement Project

Bridge painting on Farmingdale Road over Interstate 72 near Springfield set to begin Monday, May 19

Local Sports

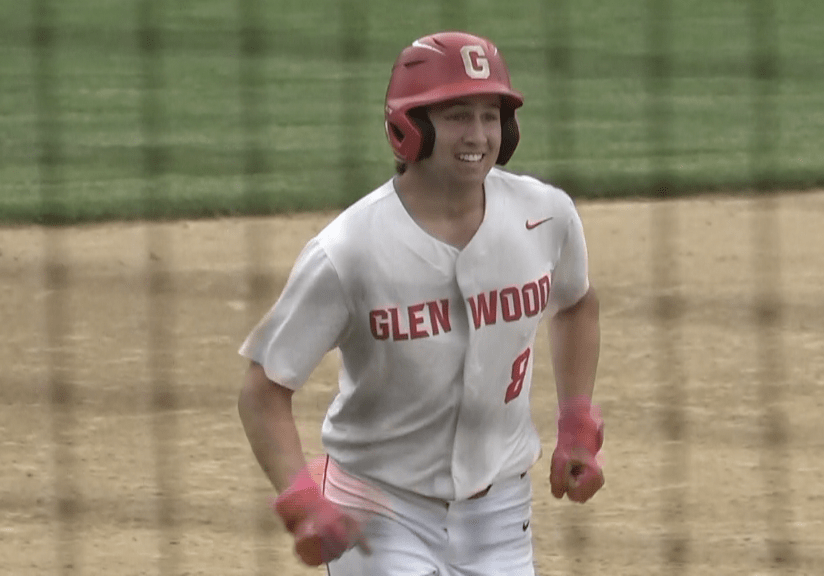

Mueller's Home Run Helps Titans Take Down Pleasant Plains

Grady Mueller hit a two run home run in the fifth inning to help power Glen...

Maisenbacher Walks It Off For Pleasant Plains In Wild Win Over Morton

Landon Maisenbacher hit a RBI single back up the middle and into center fie...

CS8 Boys Tennis Champions React to Titles

Ben Loeffler won the boys CS8 singles tennis title for Glenwood, leading th...